The beginning of the end for traditional Telcos?

Introduction

SMEs are being left behind in terms of telephony and IT because the main Telco incumbents are not advising these customers of their options, nor explaining the impact that proven, new products available on the market will have on their business. The incumbent has a vested interest in keeping its installed base of legacy hardware and systems because it delivers high margin revenue, which is being used to cross subsidise a push into the ICT space.

Though the old systems are acknowledged to be expensive and slow by comparison, they work, and many SMEs are of the mindset ‘if it ain’t broke, don’t fix it’. As these companies are not receiving proactive advice or recommendations to upgrade, most see no need to move their PBX to the Cloud, nor a need to introduce unified communications (UC).

The workplace of the future is more collaborative, more flexible, more people-oriented, but mostly, more results oriented. The technology to enable this is available now.

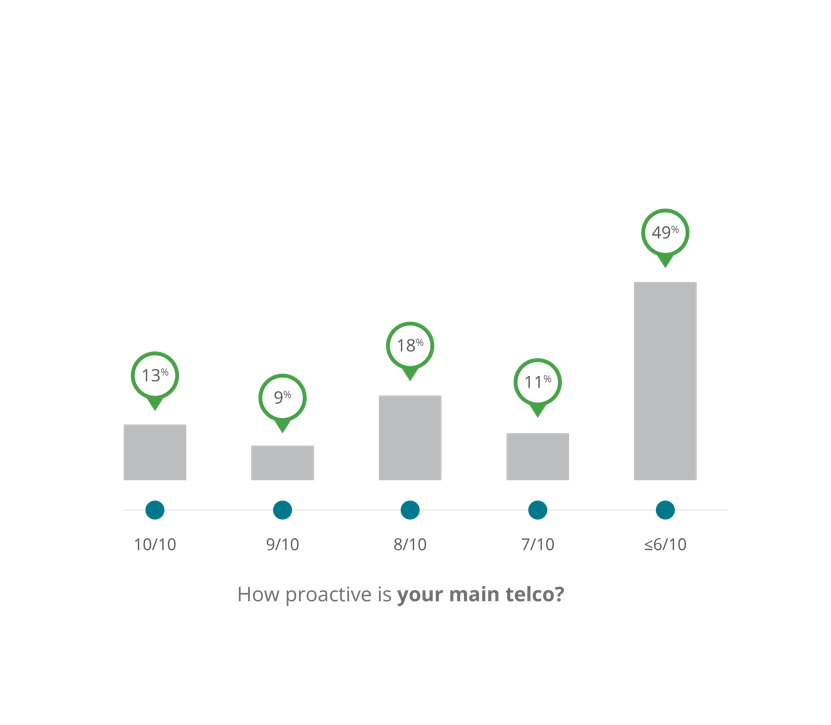

Half of the executives interviewed were not getting proactive advice from their current Telco

Half of the executives interviewed were not getting proactive advice from their current Telco

The market is set to undertake the last big cloud shift with the PBX or Phone System

The move to the Cloud and in particular Unified Communications as a Service (UCaaS) is being driven by organisations that understand how to leverage the benefits.

We are near a tipping point of accelerated growth in Cloud UC service take up and adoption, but achieving this will rely on SMEs becoming better educated and the opening of new channels to market in order to drive total market growth.

On the surface, it doesn’t look like there is much going on in the IT&T market right now:

Traditional voice revenue is falling and Global Unified Communications spend across the next four years will only grow between 1% – 4%

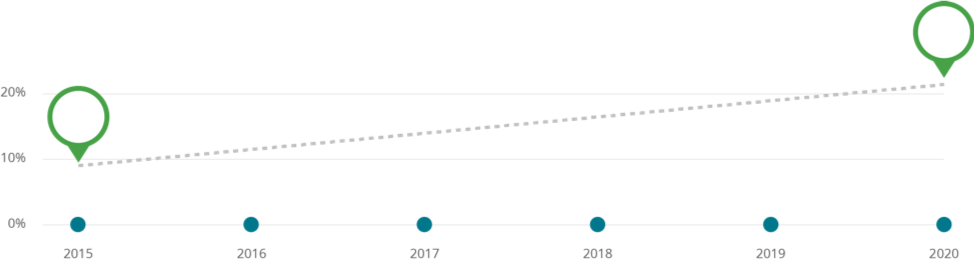

Asia Pacific will only increase UC spend by 1.1% across the four years to 2020 However, it’s a substantial shift in the makeup of this market that will be the driver of growth. That shift is the move to Cloud, and Unified Communications in the Cloud is predicted to grow from 8% market share in 2015 to 22% of the market, or $650M, by 2020. 86% of businesses in Australia are already using SaaS and have overcome historical issues such as connectivity through technologies like SDN and SD-WAN, which enable Quality of Service over the Internet.

Cloud-Based Unified Communications predicted to grow to 22% of total UC spend by 2020 across the region

Traditional Telcos are not delivering value for SME businesses

There is simply no need for customers to deal with a telco anymore because there is no need to buy traditional telco services. High-quality Internet connectivity and performance means you can just buy what you want over the net, whenever you want it and simply switch it off when you don’t need it anymore.

Access4 went to the SME market to discover its thoughts on current UC/Telephony providers and to understand what SMEs are currently experiencing and what they want from a UC provider.

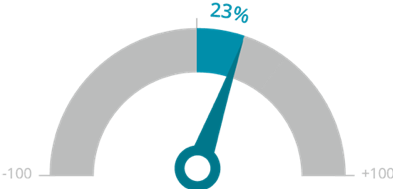

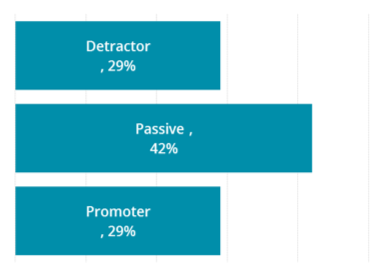

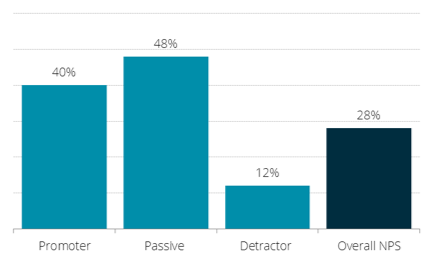

The research revealed an overall net promoter score of positive 23 so [for the most part] SMEs are unlikely to recommend their current UC/telephony provider. Because of a lack of proactive information from their provider, most SMEs are not looking to make changes to the telephony solution they currently have in place. This means there is an opportunity for a disruptor (a trusted external service provider) to step in and take this market by storm.

The research identified four key drivers that need to be in place to support the take-up and adoption of UC services in the Cloud by SMEs

- Education at the executive level to drive take up

- The route to market needs to be disruptive

- Customer experience key to ensure adoption

- Technology and service need to be seamless

Who is happy, who is not?

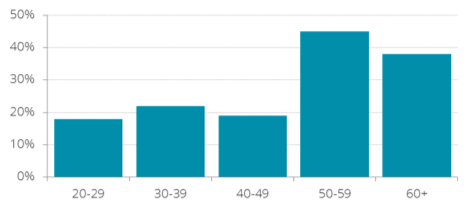

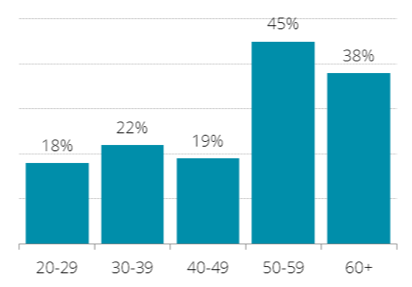

If you are male and over 50, you are the most likely to be happy with the status quo. If you are a 20-29-year-old female, you are someone who is looking to shake things up a little. In fact, 20-29-year-olds overall are the least happy with their current service provider, while 50-59-year-olds are the most loyal.

Main Telco NPS

NPS by age

Less than a quarter of senior executives have current plans to move to cloud Unified Communications

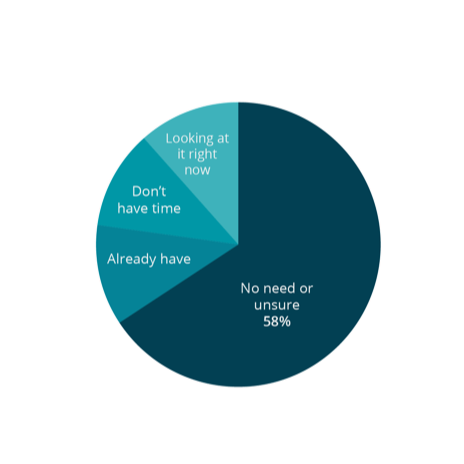

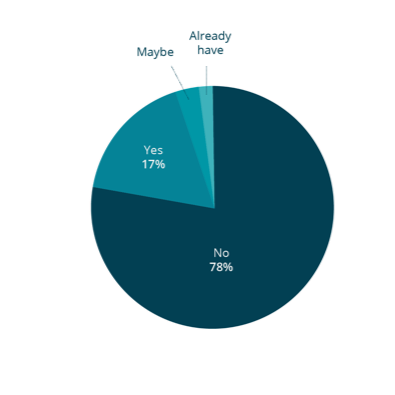

Whilst most survey respondents said they were aware of Cloud-based PBX and Unified Communications, more than three-quarters of them had no plans to move UC to the Cloud. Nearly half of those people said the reason they had no plans to move to UC was because they had ‘no need for it right now’.

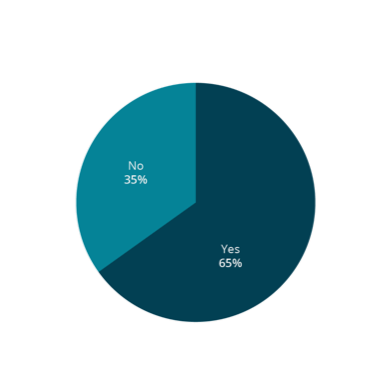

The main provider for this survey group was Telstra and the majority of respondents had their own dedicated phone system. Nearly half said they were not receiving proactive service and advice from their IT provider. Just over a third were not even aware of Cloud-based PBX and UC let alone the benefits it can deliver.

A third of respondents said they could foresee no challenges in their business regarding communications over the next 12 months.

Insights

There is certainly a lack of incentive for customers to change. The main Telco incumbents have a large installed base currently on legacy products and they don’t want to [nor can afford to] risk losing this high margin revenue ‘cash cow’. Therefore customers are managed reactively without providing strategic advice or helping to ready customers for the future.

A new route to market is required that is able to challenge the status quo. It needs to come from a credible and trusted source such as the external IT systems provider.

The channel to market must be disruptive in order to jolt these passive customers from their slumber, to show them what is possible for their business and what they are missing out on by ignoring these changes. The fact that a third of respondents are not aware indicates how little they understand the IT&T market and the changing needs of employees.

While excellent customer experience is key to SMEs adopting this new technology, education at the executive level on the benefits of unified communications is needed to accelerate change. Close to 2/3rds of executives are not exploring the commercial benefits of PAYG services, greater collaboration across the business and greater workplace flexibility.

Aware of UCaaS

Reasons why not taking up UCaaS

Have plans to move to UCaaS

Instant Messaging is more prolific than ever, yet senior executives are unaware of its use and not capitalising on it

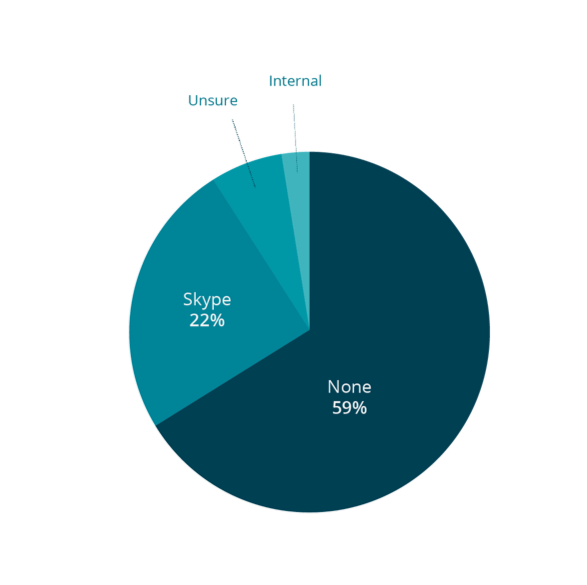

When asked if they used an application for Chat within their business, 59% of respondents said no.

22% were aware that Skype was being used; however, there was no mention of the most highly used messenger apps in Australia today- Facebook Messenger and WhatsApp or employees using SMS or email for corporate messaging.

Almost 80% of Australians have a Smartphone, and they glance at the device more than 440 million times a day. Those phones are a part of their personal and business lives. And they are used for Instant Messaging (IM) or Chat.

The IM wave is still building in Australia, and Smartphone users across all age groups are more actively using messaging apps. In 2015, 42% of Smartphone users were actively using messaging apps versus 25% in 2014.

There are 2.4M active Australian users on WhatsApp and 15M Facebook users.

What instant messaging application are you using?

Insights

SMEs are running messaging apps – but the people that run the business are not aware this is happening.

Whatever IM applications are being used across the business, they are certainly not sanctioned applications and they are clearly not being used organisation wide.

What value and IP are businesses losing? What information is leaking out of your company because you don’t have a way to capture IM data easily and effectively?

Smartphone messenger apps used to be just a novelty which not many people worried about or used that often, nowadays though you would be hard pressed to find users who don’t regularly check on their messages, by using one of the popular apps such as Facebook chat, WhatsApp, or Skype.

Messenger apps were historically popular for chatting between friends and family in real time. However, businesses are now turning to messenger apps as well, increasing their workflow and allowing real-time collaboration to take place.

The key is to ensure everyone in the business is using the same application and that the IP from messaging apps can be captured and stored.

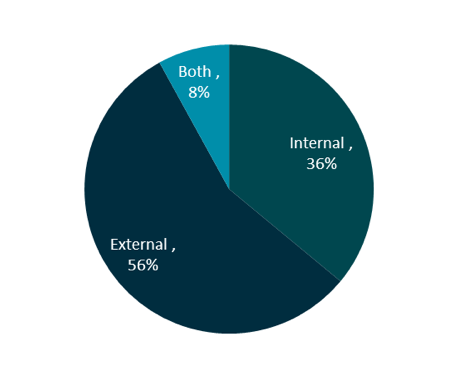

Internal IT is not the driver of change with limited exposure to external markets and a focus on “keeping the lights on”

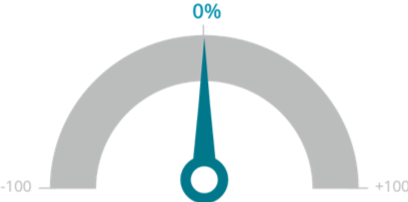

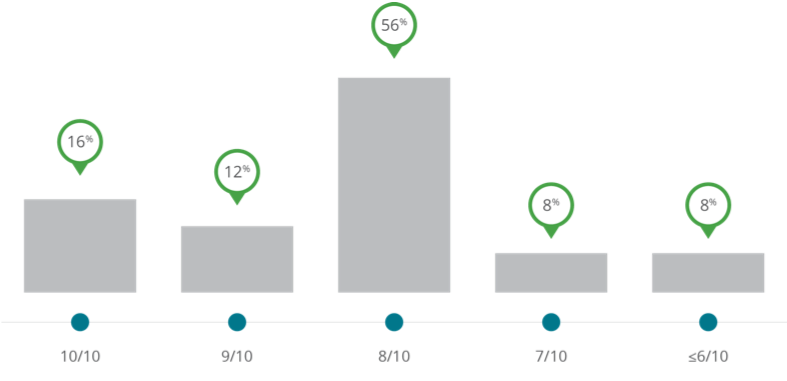

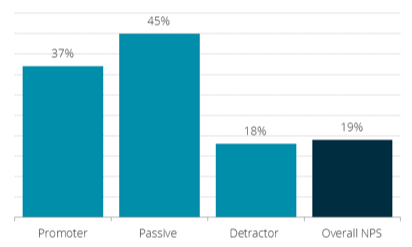

Overall the Internal IT provider received a Net Promoter Score (NPS) of 0, though 70% of respondents scored them 8 or more out of 10 for their performance.

Loyal supporters found the internal IT provider to be helpful, but everyone else wants them to be more responsive, more proactive, more available to assist and more service oriented.

It should be noted that the IT respondent sample size was only a small population of the total survey.

Insights

The much-maligned internal IT team once again comes under fire from the senior decision makers. They had the highest rate of detractors across all groups examined in the research.

Most internal teams don’t have any external or IT system integrator support. The survey identified that of the 36% of companies using internal IT management, 65% of this group do not use any form of external support services.

They are going it alone, and may, therefore, be limited in their ability to understand where the market is headed.

Isolated within the business, the internal IT team only sees the needs of their direct company. The research would seem to indicate that this group is not viewed as a strategic influencer at C-level but rather the guys who keep things running (most of the time).

Given the overall results showed that most respondents had their own equipment on site, the internal IT provider would most likely be managing these legacy systems and having to deal with sunk investments. They are probably spending their time building patches to keep the old systems working, leaving little time to look at what else is around.

Internal IT or External IT Services provider?

Internal IT NPS

The external IT services provider is seen as a provider of thought leadership and advice…

Over 50% of respondents use a medium sized external IT provider for IT management. Overall, external IT providers received an NPS of positive 44 and were found to be helpful and obliging, efficient and prompt.

The external IT provider has the highest advocacy with senior executives and the highest ranking when it comes to providing strategic advice to customers.

84% of those who use an external IT provider rated them an 8/10 or more for providing strategic planning and understanding their business.

Just using customer experience as a measure, the external IT services company is best positioned to lead the customer to a cloud UC change.

Insights

A key driver of change in the UCaaS market will be brought on by providing a disruptive channel to market. This channel must also be reliable and trustworthy and provide complementary services. As UC is currently not part of the current product range for most external IT providers, the disruption works as there is no legacy decisions/ revenue to protect.

As with IT services, external providers “can support upgrades quickly and easily over the phone”. They are already viewed as being “responsive and provide prompt service” and they communicate with their customers proactively.

Just as the Cloud discussion became a boardroom discussion – UCaaS needs to be a boardroom discussion. However, it will only get there if the senior executive adds it to the agenda. Education is the key to driving change with senior decision makers, and the external IT provider can bring this about.

External IT NPS

For external: how would they rate their external IT provider with providing strategic planning and understanding their business?

Focusing on customer service is the key to sustainable UCaaS adoption

Seamless service was the number one driver of positive customer experience, while ‘service coverage/outages’ were the number one detraction.

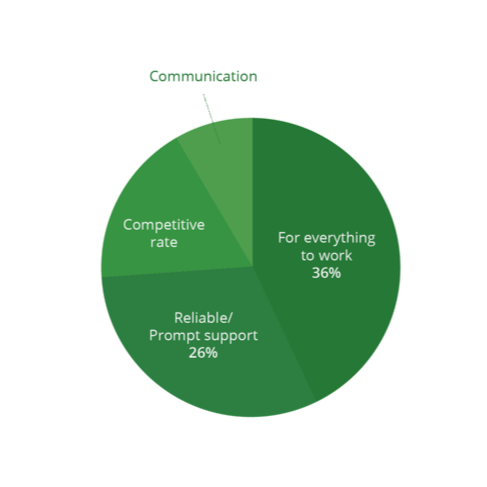

The survey respondents don’t want to be concerned with IT&T, their biggest expectation from a telco is for everything to work. They want reliable and prompt support when it’s needed and competitive pricing comes down the list after that.

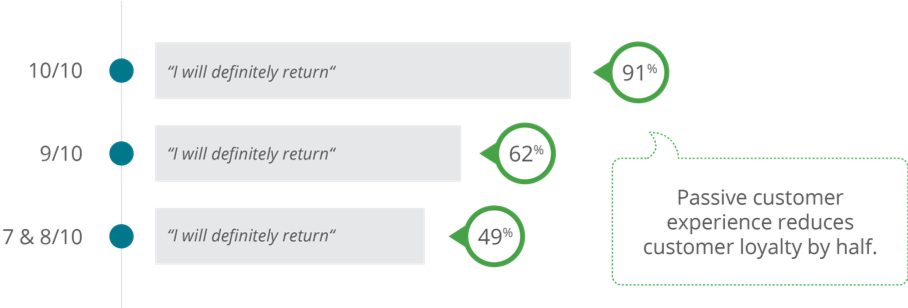

There is a direct link between total customer experience and customer loyalty. Even of those customers that [by traditional expectations] say they are satisfied with the service, only half agree they would ‘definitely return’ one year from now. The adage that good service is no longer good enough holds true in that delighted customers are the only group with strong loyalty.

Insights

The research suggests that SMEs prefer dealing with their external IT service provider rather than a telco. They are frustrated with the service levels they are currently getting from their incumbent Telco with responses such as: “you never know who to contact, and the call centre is a million miles away” (anonymous), and they know there are better solutions out there, “it takes so long for someone to come to us with a solution” (anonymous).

Businesses are moving inexorably towards procuring services ‘as a service’, which means that lock in and long term contracts will soon be a thing of the past. Telcos’ contract stickiness can no longer apply and customer loyalty won’t exist as soon as the customers’ experience falls. The customer will take their rightful place as the most important consideration for the providers and service excellence will have to be front and centre.

In a cloud market where flexibility is an expectation and a premise, the customer experience will dictate how and which providers will succeed in the long term.

.

.

Expectations of a provider

Millennials will be the drivers of change as they demand better collaboration and greater workplace flexibility

Of those surveyed, the least loyal customers were in the 20-29-year-old age group, followed closely by 40-49-year-olds. The largest detractors were in the 30-39 year age group. Generation X, Y and Z are not loyal to their telco and know they are not receiving the level of service they deserve.

Generally, males are more loyal to their current provider than females. In fact, the most satisfied group was the 50+-year-old males, and the most loyal overall were those in the 60+ age group.

Insights

The move to UCaaS needs the support of senior executives who are ready to embrace change. The leaders of SMEs need to understand where the workplace is going and put the technology in place to both support and leverage the changes that lie ahead.

By 2020 millennials will account for more than 54% of the workforce and are clearly not satisfied with how communications are provided by Incumbent Telcos today.

The workplace of the future is more collaborative, more flexible, more people-oriented, but mostly, more results oriented. More and more a company’s platform for information collaboration and workplace flexibility will play a larger role in a company’s ability to attract leading talent.

The technology to enable this is available now, and it’s reliable, cost-effective and scalable. Reluctance to change will leave these SMEs less agile, less productive and far less competitive. With so many executives not aware or not looking at UC are some heading for a Kodak moment?

NPS by gender – male

NPS by gender – female

NPS by age

About the research

How we measure the Net Promoter Score (NPS)?

We ask” “How likely is it that you would recommend <your company> to a friend or colleague?” (10 to 0 point scale) The score of 9 or 10 is defined as a Promoter. The score of 6 or less is a Detractor. Scores of 7 or 8 are neutral – this is the new ‘pass mark’

NPS = Promoters – Detractors

Interviews were conducted by Saguity during June-July 2016.

Senior Decision makers were interviewed over the phone and all results are available on request.

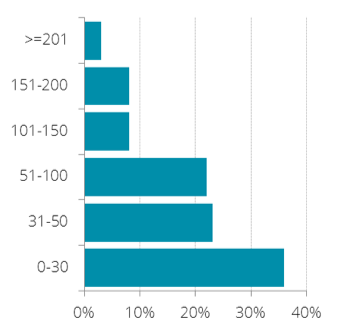

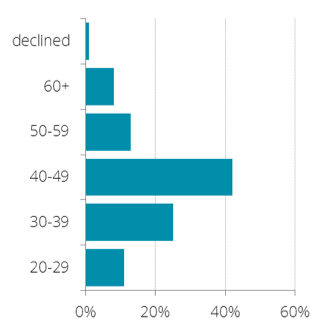

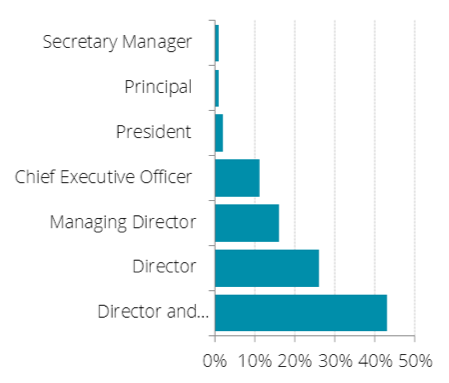

The survey was completed by the senior decision maker of 100 IT and non IT SMEs nationally.

Size of respondent organisation

Age breakdown

Position breakdown

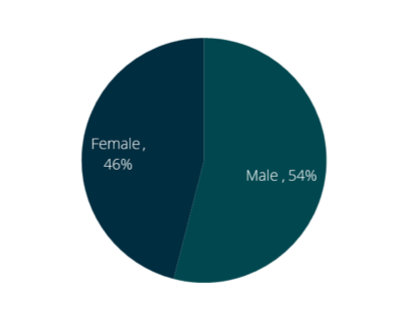

Gender breakdown

Contacts

Access4

Ruy Franco, Director of Sales & Marketing

Saguity

Darrell Hardidge, Founder and CEO

Suite 1, Level 2, 10A Atherton Rd, Oakleigh VIC 3166, Australia

+61 3 8548 1888 / contact@saguity.com

Published September 2016

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher. Any use or publication of the results/findings contained in the document must cite Access4 as the source.

Copyright © Access4 Pty Ltd 2016